Men are about 1.4 times more likely than women to earn a monthly income of ₦1,000,000.

2024

In 2023, we asked 1000 Nigerians about their relationship with money.

We learned a lot from our findings — lessons we have implemented through small and big changes to Piggyvest’s features. We have gotten to know our users better and learned that there is no such thing as too much data if you want to solve money problems.

So, this year, from June to August, we surveyed over 10,000 Nigerians — of different ages, genders, and income brackets - about their saving and spending habits. We also asked about debt, inflation, business, and their financial plans for the future.

The results are in, and they suggest that a lot can change in a year.

Scroll

Chapter One

Income

Income

We asked:

37% of our respondents said they earn below ₦100k.

Adaora*, a 23-year-old salary earner based in Enugu:

“It’s like peanuts these days, earning ₦100k.”

vs.

2 23

23

Women edge ahead of men in the lower income categories (below ₦250,000), with about 59% of women earning below ₦250,000, compared to 49% of men. However, in higher income categories, men outnumber women. Men are about 1.4 times more likely than women to earn a monthly income of ₦1,000,000, and men are almost twice as likely to earn a monthly income of ₦5,000,000 and above.

Because of the burden of care, women have less time to spend in the labour force. This affects the amount of hours a woman has to devote to income-generating work, and inversely how much she can earn from work.

— Fadekemi Abiru

Head of Insights, Stears Inc.

We also asked Nigerians how many income streams they had

We also asked Nigerians how many income streams they had

Of the respondents who reported having a monthly income, a little more than 7 in 10 said they rely on only one income stream, while less than 3 in 10 rely on two or more income streams. Our findings suggest a decrease in Nigerians with more than one income stream compared to last year.

vs.

2 23

23

Across Generations

One Income Stream

Two or More Income Streams

Millennials are the generation most likely to depend on a single income stream.

Chapter Two

Spending

Spending

We asked:

A little over one in three Nigerians spends between ₦50,000 and ₦99,999 on average each month, not accounting for emergencies.

A little over 1 in 3 Nigerians reported spending between ₦50,000 and ₦99,999 each month, making it the most common average monthly expense range. The next most common category was those spending below ₦50k, accounting for 1 in 3 Nigerians. Meanwhile, the least common spending category was those who reported spending ₦1,000,000 and above monthly, with about 1 in 100 Nigerians falling into this group.

We asked Nigerians what their most significant monthly personal expenses are

We asked Nigerians what their most significant monthly personal expenses are

Over 80% of our respondents picked food and groceries as one of their biggest monthly personal expenses.

A little over 7 in 10 Nigerian income earners pay black tax. Of those who pay black tax, 65% report paying it monthly; only 35% pay it occasionally.

Mr. Ekene Justice*, a Keke driver, says,

“[Black Tax] affects my financial status so much it doesn’t even allow me to breathe. Any money I get out of the business, there is already a problem standing there just to answer.”

Chapter Three

Savings

Savings

vs.

2 23

23

Mr James Uche*, a Civil Servant based in Plateau State:

“I used to save, but the increase in school fees, electricity tariffs, and even the cost of fuel has made it very difficult to continue. It has really taken a toll on my savings and affected my ability to save.”

It's undeniable that saving has become more difficult for many Nigerians in the current economic climate. Rising living costs, shrinking disposable incomes, and financial uncertainty make it challenging to set money aside. But, it's more important than ever to hold on to these savings habits, even in the face of these difficulties. Saving provides a crucial cushion against financial emergencies—whether personal or national—and builds resilience.

— Odunayo Eweniyi

COO, Piggyvest

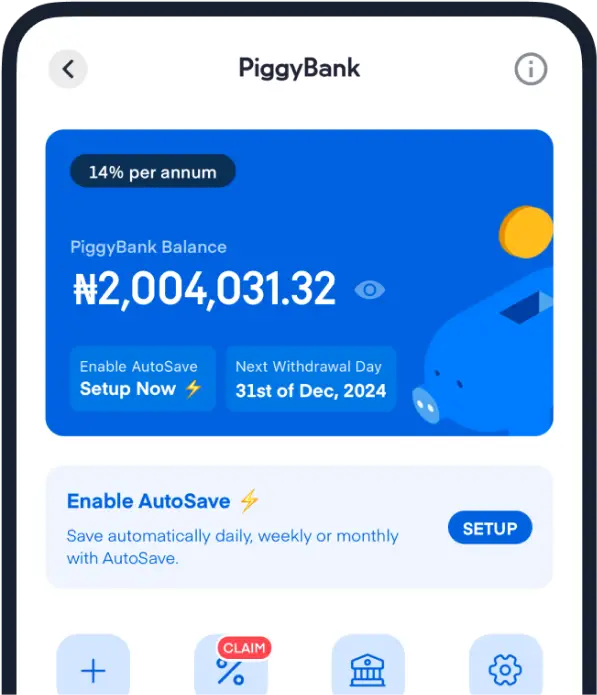

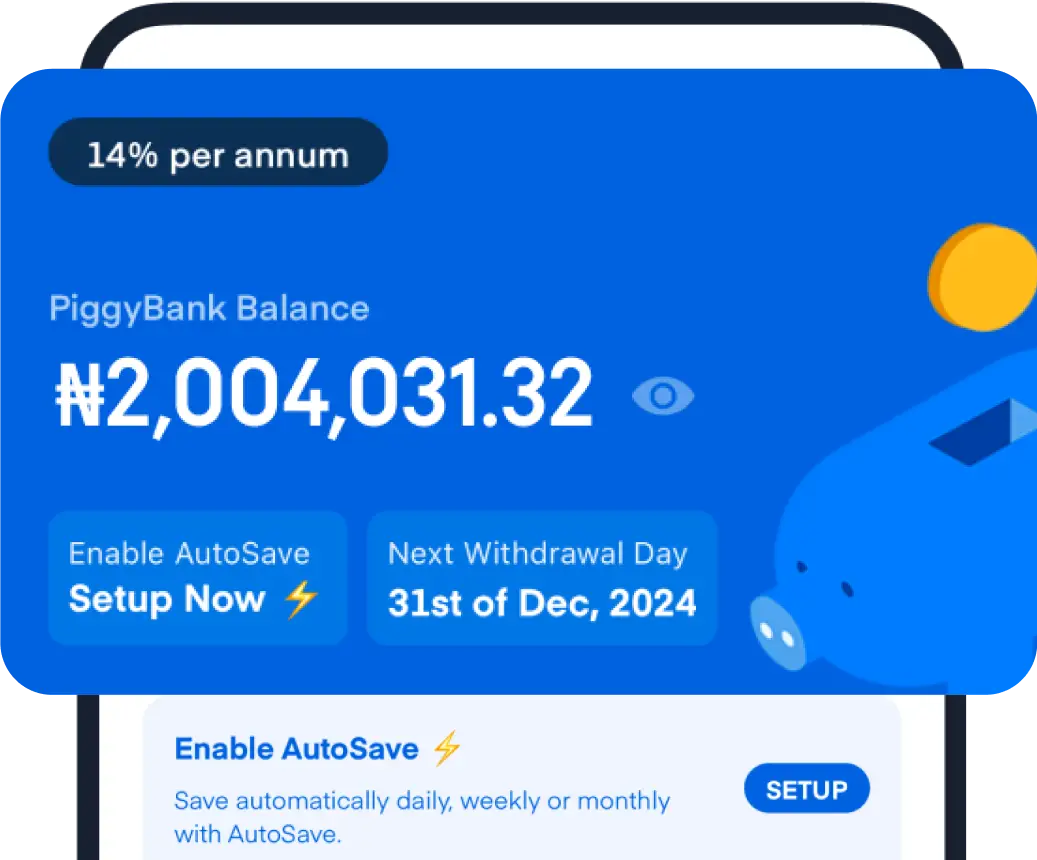

Stay prepared for life's emergencies!

Starting or growing a business is the second-ranked short-term savings goal for Nigerians.

In 2023, Japa was the savings goal for 21% of Nigerians. Since then, it has dropped behind seven other goals, like personal education, buying a car, and rent/housing, and now represents just 10% of immediate savings goals.

Odunayo Eweniyi, COO Piggyvest says

“At Piggyvest, we offer features like savings automation and breaking down saving into manageable, bite-sized bits that align with whatever people can afford to set aside. We know that for many, saving even a tiny amount can feel like a sacrifice, which is why we strive to make saving as seamless, unintimidating, and accessible as possible, tailored to the financial constraints people face daily.”

Save with as little as ₦1,000

Chapter Four

Emergency Funds

Emergency Funds

More than 6 in 10 Nigerians don’t have emergency funds, which allows them to take care of emergencies without incurring debt.

Across Generations

Younger generations, particularly Gen Z, are less prepared for financial emergencies. Generation Z is the least likely to have emergency savings, while older generations seem to be somewhat better equipped. Generation X shows the highest level of financial preparedness for emergencies, followed closely by Boomers and Millennials.

Generation X shows the highest level of financial preparedness for emergencies, followed closely by Boomers and Millennials.

Chapter Five

Debt

Debt

A little over 2 in 10 Nigerians report being in debt.

vs.

2 23

23

Across

Generations

GenX Nigerians have the highest likelihood of being in debt.

We asked Nigerians who they’re in debt to.

We asked Nigerians who they’re in debt to.

Over four in 10 Nigerians in debt are indebted to their family and friends. Specifically, of every 100 Nigerians in debt, 45 are indebted to a friend or family member.

Fadekemi Abiru, Head of Insights, Stears Inc., says

“Borrowing from friends and family is a sign of the resourcefulness of Nigerians and the strong community bonds and high trust within these communities. Still, it does not have the same impact as institutionalised credit facilities. This form of borrowing also makes it difficult to transmit monetary policy successfully.”

We asked Nigerians in debt how much they owe.

We asked Nigerians in debt how much they owe.

Among those who reported debt, the largest group—over 1 in 4 —owe less than ₦50,000.

The most common factor people believe led them into debt, accounting for 26% of all cases of debt, is a major expense, such as a car, rent, education, or wedding. Business needs follow closely behind, responsible for driving nearly 1 in 4 Nigerians into debt.

The most common factor people believe led them into debt is a major expense, such as a car, rent, education, or wedding.

Chapter SIx

Business

Business

26% of our respondents - almost 3 in 10 - say they do.

While both men and women are actively engaged in business ownership, women are notably more likely to own businesses than men.

Chapter Seven

Inflation

Inflation

87% of our respondents say they have. This tallies as within the past year alone, the national inflation rate has gone from 25.08% in 2023 to 32.15% in 2024.

Nearly 9 in 10 Nigerians say they have noticed an increase in their general expenses in the past year.

Melody*, a student in Abakiliki, says:

“My expenses have gone up—transportation, feeding, even the cost of textbooks in school—so it's affecting me, and sometimes I'm really running out of cash.”

We asked: Which specific areas of your expenses have seen the most significant increase in the past year?

We asked: Which specific areas of your expenses have seen the most significant increase in the past year?

Food and groceries are the personal expense category most impacted by inflation, followed by transportation, utilities, and personal upkeep.

Chapter Eight

Future Plans

Future Plans

About 1 in 2 Nigerians say it’s financial freedom.

While Japa still appears as one of Nigerians' long-term goals, it has become less of a priority, as only 16% of Nigerians have it as a future goal they’re working towards.

Conclusion

Conclusion

Nigerians have become more acclimatised to rising expenses due to incessant inflation. These pressures are particularly challenging for those in lower income brackets, who must contend with reduced purchasing power and the added weight of high living costs.

Despite these difficulties, there are steps individuals can take to guard their finances and adapt to the economic climate. Here are a few actionable tips:

Automate savings to battle lifestyle inflation.

Prioritise necessary spending.

Invest in inflation-resistant assets.

Explore auxiliary income flows.

Invest in alternatives that cut recurring costs.

The better way to save and invest!

Join over 6 million users to save and invest with ease.